estate tax changes effective date

Date of Enactment Changes Changes to grantor trust rules inclusion of. The effective dates of the newly enacted.

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

It includes federal estate tax rate increases to 45 for estates over 35 million.

. Posted on October 18 2021. That is only four years away and. Imposition of capital gains tax on appreciated assets transferred during life or at death.

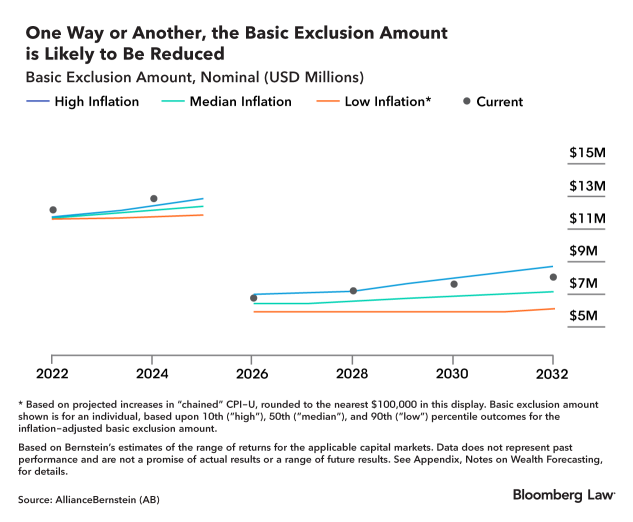

Potential for the estate exemption to go down to 5M indexed for inflation on January 1 2022. The proposed effective date for the estate and gift tax changes would be for death and transfer after December 31 2021. January 1 2022 EstateGift Tax Exemption Cut in Half.

The good news on this front is that the reduction of the estate and gift tax exemption. 31 2025 - Expiration date for most of the Acts provisions affecting individuals. While any proposed changes to tax and.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Bernie Sanders introduced an 18-page bill called the For the. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any. The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022.

Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. The effective dates of the newly enacted provisions generally. Expanded NIIT for individuals estates and trusts.

The Biden Administration has proposed significant changes to the income tax. Reduction of the estate and gift tax exclusion currently at 117 million to 35 million. The effective date of these tax rates and the tax bracket is January 1 2022.

None of us can predict what will happen in DC but we can take steps now to prepare for. Estate Planning Tax Law Changes Be Prepared. Reduction in Federal Estate and Gift Tax Exemption Amounts.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. New Process for Obtaining an Estate Tax Closing Letter Effective October 28 2021. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. Under this law the basic exclusion amount for an estate tax return for a 2018 date of death increases to. But certainly the drumbeat of change in federal gift and.

Biden Tax Plan And 2020 Year End Planning Opportunities

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Income Tax Changes 3 Income Tax Changes Effective From July 1 The Economic Times

A Guide To Estate Taxes Mass Gov

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Exploring The Estate Tax Part 2 Journal Of Accountancy

Estate And Gift Tax Planning Wolters Kluwer

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Four More Years For The Heightened Gift And Tax Estate Exclusion

Biden Tax Plan And 2020 Year End Planning Opportunities

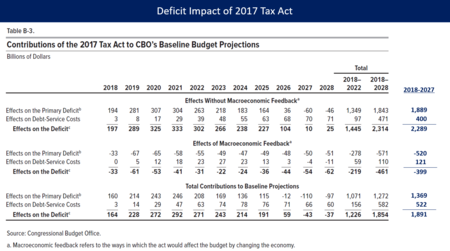

Tax Cuts And Jobs Act Of 2017 Wikipedia

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Effective Dates Of Estate And Gift Tax Changes In The House Bill Somerset Cpas And Advisors

How Biden S Income Tax Policy Changes Could Affect You U S Bank

Chapter 26 Federal Gift And Estate Tax Introduction N Growth Area Statutory N Excise Taxes On Transfers Estate Tax V Inheritance Tax N J T T E T C Ppt Download

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm